Executive Summary

This paper will challenge the supposition that “logistics” is a chain, and further reject the notion that it is comprised of two distinct sides, supply and demand. The chain portrays logistics to be stagnant and linear; it also suggests that supply and demand are two separate chains. This view causes rigidity of thought and creates a contrary set of theoretical business rules, forcing those involved to think within those limitations.

Logistics is dynamic! It is comprised of many moving components that continually interact, constantly adding substance to an evolving process. The very definition of logistics, “the discipline that manages the flow of raw material through the finishing process and responsible for customer satisfaction”, clearly demonstrates that its current representation as a chain is in direct contravention of the “flow”. It will also be argued that there are no distinct sides, that supply and demand is part of a continuous cycle.

This white paper will:

- Challenge the notion that logistics is a chain

- Propose that there are two major components of logistics

- Identify macrologistics and a representative sample of the major and sub-components of micrologistics

- Discuss the logistics dichotomy

- Discuss evolving logistics concepts

Why Is This Subject Important?

In decision making theory, understanding differences and the levels of difference is a mission critical element that must be incorporated and operate pervasively throughout the entire decision process! The complexity of logistics as it relates to today’s and tomorrows worldwide commerce requires a clear understanding of these various differences and a fresh look. The current concept that logistics is best described as the “supply and demand chain” whose links portray the functional elements, incorrectly postures logistics as being linear and unfluent. Logistics is a fluent and dynamic process; the “chain” must be replaced in order to maximize the benefits and to bring this important discipline to the next level!

Knowing that there is a difference between micrologistics and macrologistics will allow you to effectively and efficiently:

- Identify weaknesses

- Identify areas of opportunity

- Select the most appropriate tools, products and services

- Achieve successful collaboration

- Reach in to an enhanced database

- Affect improved communications

- Establish new reasoning paths for study and analysis

Limitations of the Chain

Logistics and supply/demand chain are words that are incorrectly used interchangeably and to describe each other. It therefore follows that the application and reasoning are circular; so, effective articulation, with resultant success, is impossible. These factors, coupled with the belief that logistics is a chain have made the goal of world class logistics excellence amorphous. If the notion of the chain continues to represent logistics, we will see a continuation of insufficient ROI, underutilization, poor response to tasks and events and a significant misuse of management intelligence, talent and time.

Because needs are constantly changing and because there is probably an equal number of solutions occurring, it becomes exceedingly more difficult to efficiently and effectively match a need or needs with the appropriate solution or solutions. The “chain” limits our abilities and capabilities because it is serial and of singular dimension. Further, Navi Radjou, of Forrester Research, in his article (Supply Chain e-Business, July/August 2002), “Exit supply chains; enter adaptive supply networks”, states, “Existing supply-chain apps don’t help manufacturers sense or respond to changes in their operations network because they insulate static plans from dynamic execution reality.” By virtue of these restrictions, our thoughts have been channeled into believing that our only tool is one that is “comprehensive”. If we only have a limited number of needs or just a few needs that must be satisfied today, acquisition of this comprehensive tool is likened to, “squeezing an orange grove for a glass of juice”.

Since logistics is responsible for managing, integrating and controlling the flow of information, material and money, it must have the capability of targeting a specific issue and establishing the best method of approach. In order to plan and control these flows, the current view of logistics as a chain has been unable to keep up with the needs analysis and the selection of effective solutions.

Logistics professionals recognize and appreciate the importance of, “squeezing only the appropriate oranges, so as to extract the correct amount of juice” and they clearly understand the importance of a continual harvest. Logistics portrayed as a chain continually forces the belief that identifying issues and solving problems must be performed in linear or serial, flat, static and unfluent environment.

Most companies throughout the world have embraced logistics and its importance in achieving superior customer service, operations and profit improvement. There has been a proliferation of logistics software systems, products, tools and services over the last several years. They are offered by general developers, 3PL’s and by other companies whose initial development purpose was for internal use. Further, there has been a great deal of dialog within and between companies, addressing the subject specifically for the benefit of those business partners. Additionally, the dialog is occurring in many forms such as, seminars, case studies, white papers, webinars, on-line communities, management presentations, lectures at educational institutions and advertisements. Through this labyrinth, little consensus has been achieved, therefore diminishing the ability to achieve a higher level of logistics success as well as limiting effective collaboration. It is clear that the logistics discipline and practice needs to evolve.

An Awakening

At least, one company recognized that there is a logistics dichotomy and has developed its products, tools, services and systems from a “new” perspective, “simpler is better”. As a Transportation Management Services Provider it focuses on incremental and connectible discrete vertical products and service offerings within the Transportation Management Spectrum. Consistent with this perspective, this approach recognizes and appreciates the importance of getting its glass of juice from one orange. Through this understanding, logistics can continue to evolve, reaching higher levels of benefit, understanding and acceptance.

Two Major Components of Logistics

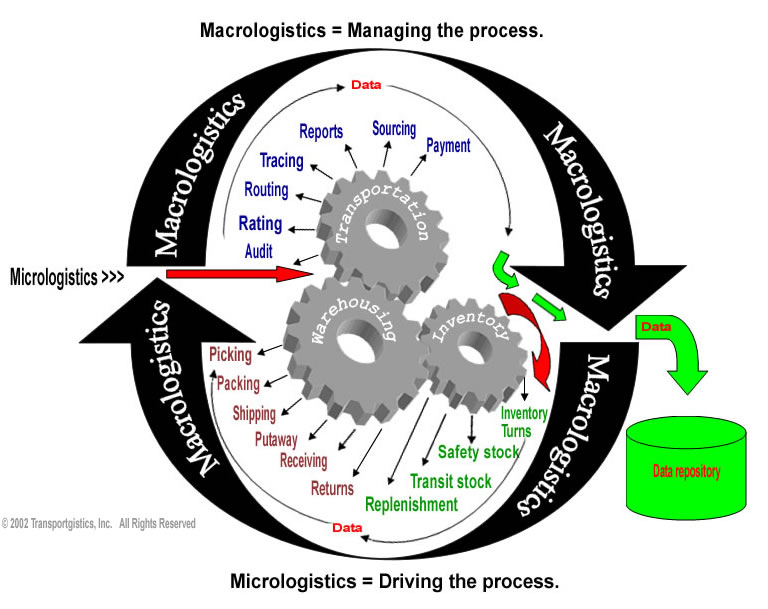

The notion of this paper is that logistics should be viewed as a set of gears; the gears collectively represent macrologistics, while individually they represent micrologistics. At the micrologistics level, each of the cogs represents the discrete logistics functions. The graphic below will symbolize this proposition.

Basis for the Words

At the outset, it is important to point out that there are no commonly used definitions of micrologistics and macrologistics. The definitions of these terms that have been reviewed were found to be product oriented, or identify the name of a logistics company or division and therefore are inconsistent and diverse. In order to properly understand this topic it is imperative that shared definitions be established. The method of approach that we selected to establish the shared definitions for this paper, was to first consider the pure words, micro and macro, and then to consider analogous terms. Microeconomics and macroeconomics have been chosen as the terms that are most analogous to micrologistics and macrologistics. By substituting appropriate words within the definitions, we believe that reasonable definitions of micrologistics and macrologistics have been achieved, at least, for this paper.

Shared Definitions for this Paper

Logistics is the discipline that manages the flow of raw material through the finishing process and is ultimately responsible for customer satisfaction.

Micro is defined as, Basic or small-scale.

Macro is defined as, Large in scope or extent; large-scale

Microeconomics is the study of the operations of the components of a national economy, such as individual firms, households, and consumers.

Macroeconomics is the study of the overall aspects and workings of a national economy, such as income, output, and the interrelationship among diverse economic sectors.

Micrologistics is the study of the operations of the components of logistics, such as transportation procurement, inventory control, data, freight tracing-audit and payment.

Macrologistics is the study of the overall aspects and workings of logistics.

The Logistics Gears Drive Logistics

The graphic below identifies an overview of logistics and considers “gears” instead of links in a chain. Essentially, gears demonstrate fluidity, while links in a chain are stagnant. This distinction recognizes the fact that there is a moving force or engine that drives logistics and reinforces the fact that logistics is dynamic. In the operating logistics process, one change causes another change. The application of dynamics enables logistics and transportation professionals to intelligently identify and forecast their needs and assign achievable goals. An inherent advantage is planned response with predicable results.

Separating the Overall from the Components

Macro logistics are represented by the gears collectively in the above graphic and as such would be concerned with the overall aspects and workings of logistics management. The individual gears would represent micro logistics and address the components of logistics, such as transportation, inventory, and warehousing. The cogs on the gears represent the respective subcategories.

As an example, Transportation as a micrologistics component could have the following subcategories: rating, routing, tracing and tracking, sourcing, auditing and payment, management reports.

Warehousing’s cogs could include: receiving, put-away, replenishment, cycle-counting, picking, packing, shipping, kitting, returns.

Inventory’s cogs might include: turns, safety-stock, cycle-stock, transit-stock, strategic-stock, replenishment frequency, consignment-stock.

The Logistics Gears; Driving the Process

The Macrologistics and Micrologistics Model

The ability of the gears and the cogs to be interchangeable coupled with the dynamic benefit would free logistics professionals from the static chain by allowing them to include the gears of choice along with their respective cogs. The gears and cogs are interchangeable and incremental. As an example, you could easily move shipping from warehousing and place it in transportation. Relative position of the gears along with their size will influence the speed or velocity at which the logistics process moves. Since macrologistics is concerned with the overall aspects and workings of micrologistics, managing the process is empowered with an entirely new dimension.

As TransportGistics, Inc. continues to evolve this model, collateral applications will be completed. Dynamic interaction with real-time functioning will facilitate analysis and collaboration. The inclusion of each interchangeable “gear set” will provide a highly coherent and dynamic representation of logistics.

Conclusion

The subject of this white paper is new and represents an evolving process. Our next paper in this series will address, amongst other subjects,

1. Micrologistics and Macrologistics, the basis of distinction and operation

2. Their interrelationship collectively along with their interdisciplinary aspects